About the Customer

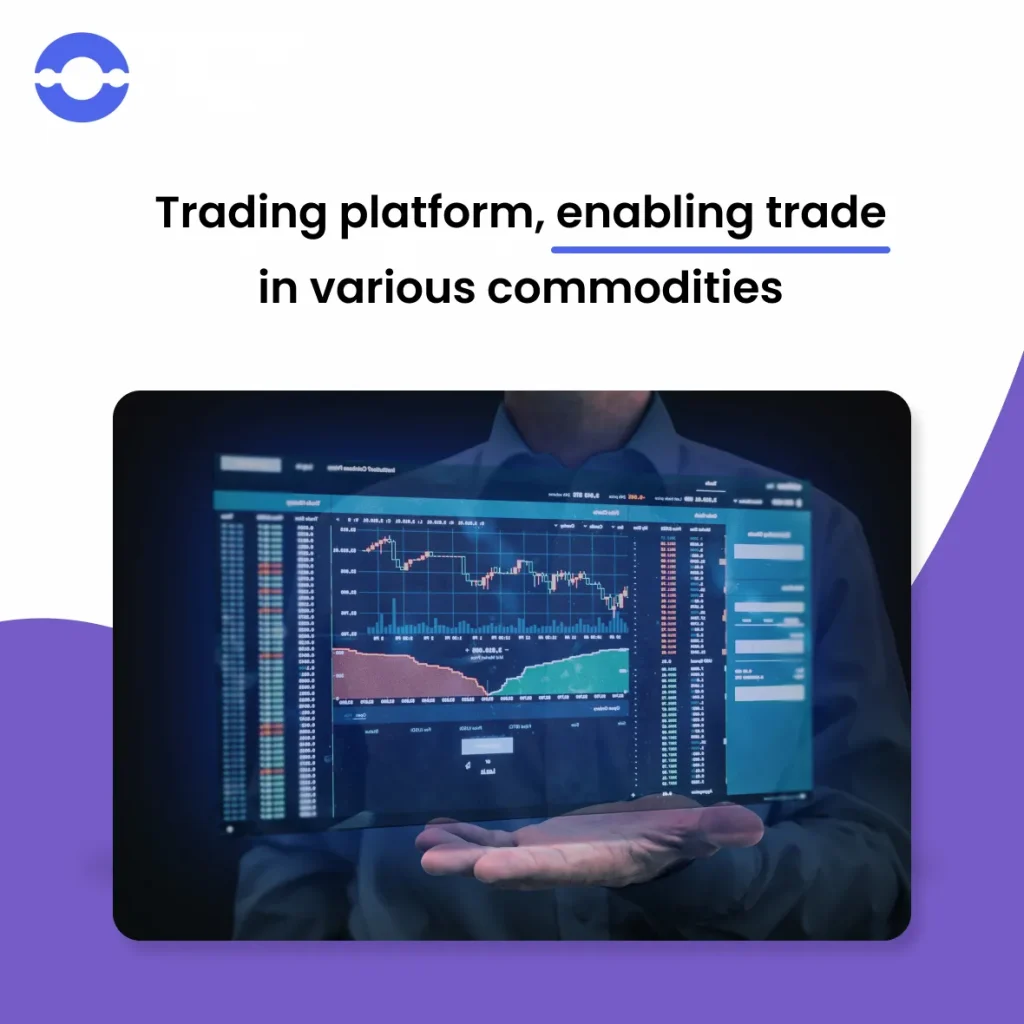

- The client was keen to develop a trading platform that allows state-owned and private entities to trade in energy as per their operational needs.

- In earlier days, the energy sector was primarily dominated by state-owned entities, however, post-liberalization of the energy sector, our client saw an opportunity and entered into the trading space.

- The company provides a range of trading services, including online trading platforms, research and analysis tools, investment advisory services, and market data and news feeds for various energy-related products such as oil, gas, electricity, and renewable energy sources.

- Additionally, it provides access to a diverse range of energy products and derivatives, including futures, options, and swaps.