Mobile apps solve the problems of every industry, and insurance is not an exception in this case.

Imagine a scenario when you are standing in a queue at a bank for cash withdrawal, and you receive a notification regarding renewing your insurance policy.

The entire process looks painful when you need to call the insurance provider, and he is not picking up your call.

When you step into the insurance company, you suddenly forget your policy number, and you go through the pain of doing lots of paperwork.

By developing a health insurance mobile app, you can complete the process within a few taps.

This was just a simple case from a customer’s perspective. From an insurance company’s perspective, a mobile app helps you manage everything through one device.

Countless businesses are coming into the Insurance sector, and they don’t realize the importance of having mobile apps.

Digital transformation impacts every industry, and insurance companies should capitalize on this opportunity to serve their customers better and stand out from the market.

In this blog, we will study the health insurance market statistics and the challenges that health insurance companies face.

Besides that, we will let you know our 7-step health insurance app development process that we have been following for our clients over the last decade.

Let’s dive right in.

Overview of health insurance app market

Firstly, let’s understand the potential of the health insurance market. So, we have mentioned some market statistics to make you understand why you need to develop a health insurance app.

- Data reports from Verified market research suggest that the global healthcare market is expected to reach $665.37 billion by 2028.

- The US healthcare insurance market stands as the largest in the world. In fact, 8% of the US population does not have health insurance because of the increasing cost of premiums.

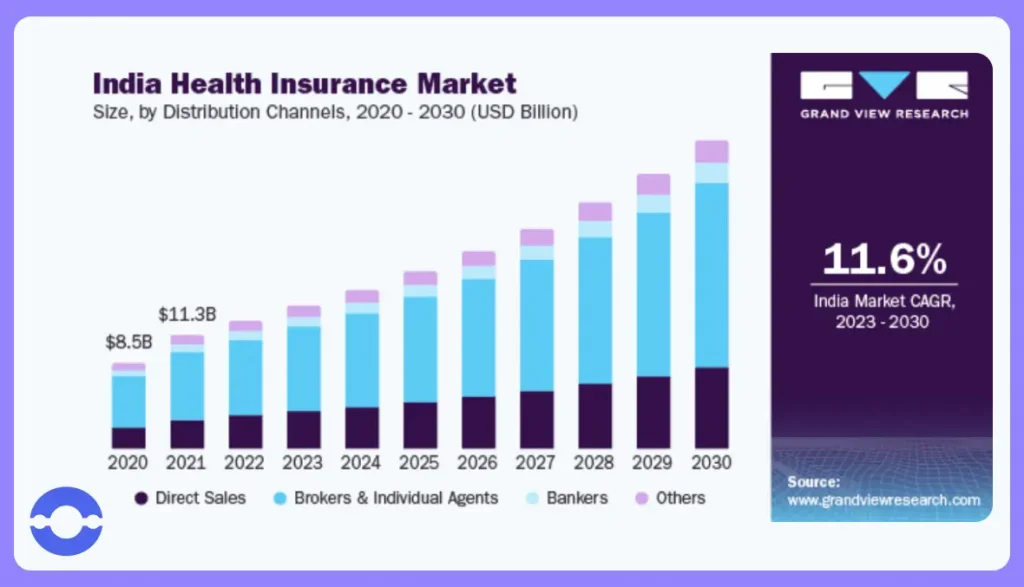

- The Indian insurance market is expected to have incremental growth at a CAGR of 11.54% from 2023 to 2030. The rising cost of health insurance in India is due to high-quality healthcare and longer life expectancies.

- The largest contributor to the insurance market is health insurance.

- Revenue generated by health insurance is expected to compound by $1.2 trillion by 2023

- Oscar was the first company that had a health insurance app and started their digital journey with 1 million members at that time.

What is a healthcare insurance app?

A healthcare insurance app lets customers quickly manage their insurance policies, monitor their claims, and receive personalized support from insurance providers.

Developing a health insurance app is pivotal these days. These apps provide quick access to patients to select the best doctors on the go and get the medical support they deserve.

People in developed countries such as the US won’t be able to get high-quality medical treatment without having health insurance. That’s why they intend to opt for health insurance coverage.

3 Major Challenges in the Health Insurance Industry

- Customer expectations are rising. They want their queries to be resolved in real time because one single bad experience takes your customers away. With traditional health insurance, most processes were time-consuming.

- Conventional health insurance requires customers to fill in lengthy forms and keep track of documentation. In such a case, customers get a disappointing service at the end, leading to maximum paperwork and minimum convenience.

- There was not a one-stop shop in the case of traditional health insurance, making it challenging for customers to find a doctor because there were long queues of appointments.

To overcome such challenges, you need mobile health insurance apps, and partnering with the right mobile health insurance app development company can do the job for you.

Why do you need mobile apps for the health insurance business?

The above-mentioned in the health insurance industry are slowing your growth. Now, we’ll discuss how you can make your health insurance business profitable by investing in these mobile apps.

1. Facilitates seamless communication

With a health insurance app development, there will be a seamless flow of communication between clients and your company. Mobile apps make it easier for patients to access insurance policies with few taps.

They no longer need to wait for long phone calls to seamlessly file their claims using a mobile app, and insurance companies can optimize their workflows.

2. Say No to paperwork

The availability of health insurance apps makes it easier for users to store and access all the information in real time.

They need not worry about taking out printed claim records or writing loads of documents in a cabinet because a health insurance mobile app solves your problem forever.

3. Get quick access to a plethora of insurance plans

When dealing with health insurance companies, selecting the right insurance policy often becomes challenging for customers as many options exist.

A mobile app for health insurance organizes information and helps patients choose the right plan according to their needs, preferences, and affordability.

4. Enhances overall productivity

Data reports highlight that 78% of business leaders believe that task automation increases the productivity of all stakeholders.

The same applies to the insurance sector as well. Developing a health insurance mobile app provides multifold benefits such as –

- Reduces human errors

- Generate reports automatically

- Update patient information in real-time

5. Maximizes revenue

Another prominent benefit of health insurance mobile app development is that it maximizes revenue through automation, resulting in a reduction in paperwork.

Such automation enhances your customer experience, and processing customer requests effectively results in higher client flow. More users make your business more profitable.

Features of health insurance mobile apps

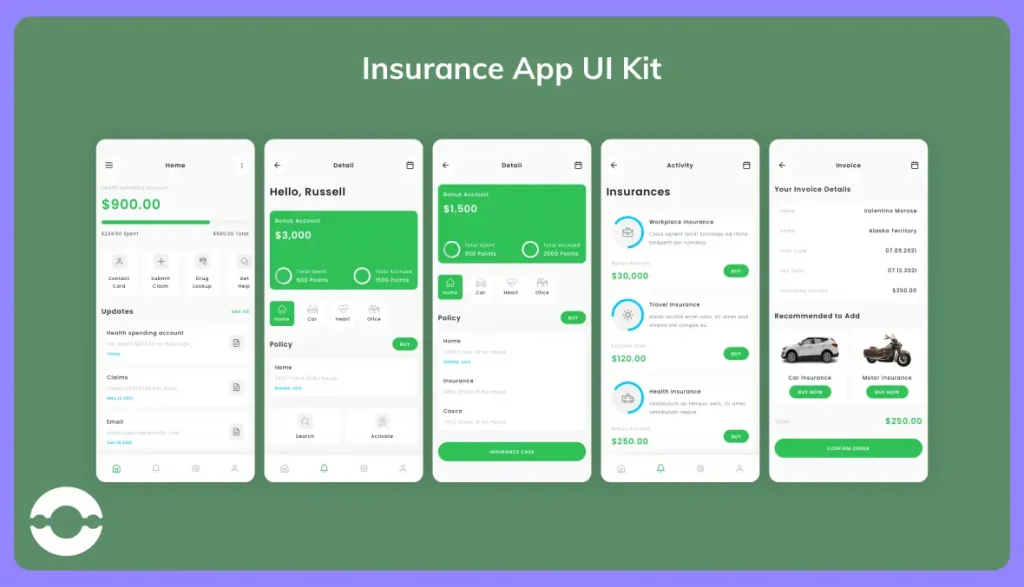

Here are the MUST-HAVE features in developing a health insurance mobile app –

1. User profile

Such a feature allows users to create and manage their profiles through contact details, e-mail addresses, policy details, and other information.

The login process should be super straightforward and simple, which enhances the overall user experience.

2. Management of claims

Earlier, users had to report to agents’ offices or send documents for managing claims.

Now, users can submit, process, and track the status of insurance claims directly through mobile devices.

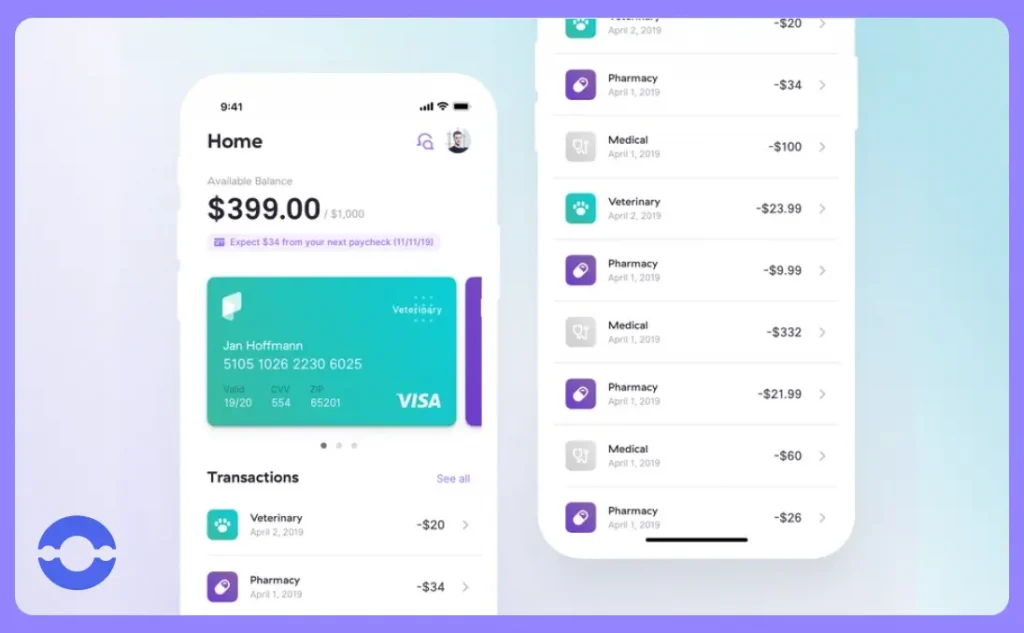

3. Managing payments

Having secure and multiple payment options makes it easier for customers to pay directly for premiums, medicines, or doctors. A secured and in-app payment gateway allows users to make hassle-free payments for availing life insurance services.

For Instance – Oscar provides a feature called automatic payments, where the app automatically deducts premiums every month. Thus, users always remain stress-free, as they would never miss their payments.

4. Live chat support

This feature increases patient engagement rate as they can connect with doctors and health professionals and get live chat, voice call, and video call support. Thus, it provides a hassle-free patient experience for one-to-one consultation sessions about policies and claims.

5. Multi-factor authentication

After covid 19, there has been an increasing surge in cyber-attack cases. It has been found from data reports that businesses without multi-factor authentication (MFA) are at a greater risk than those who have this.

By enabling MFA, insurance companies can protect their patient’s data from unauthorized access.

Cyber attackers won’t be able to access your app as it has multiple layers of protection, such as mobile PIN, OTP, and biometric verification.

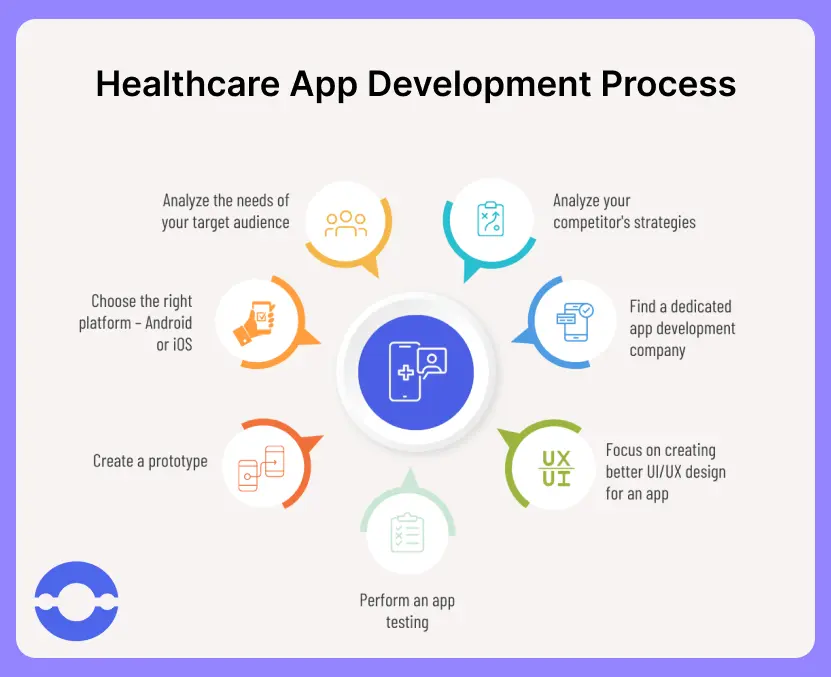

7-step process to build a health insurance mobile app

Firstly, you must consult a mobile app development company with expertise in creating health insurance apps.

Here are the exact steps we follow while creating a health insurance app-

1. Analyze the needs of your target audience

The first step involved in creating a health insurance mobile app is to define your app idea and what you want to achieve. Have clarity as to what your target audience needs are and what they expect from you.

To give you a gist, here are challenges that customers usually face with the traditional insurance model – excess of paperwork, lack of communication between health professionals and insurance companies,

You can identify client goals and preferences by doing thorough market research.

Generally, there are various underlined goals behind having a health insurance app-

- Claim management

- Finding a reliable health professional in their area

- Choosing a suitable health insurance plan

- Communicate with healthcare professionals and get constant support from them

An unclear vision will put you in a situation where you will likely face unexpected budget expansions and last-minute changes.

2. Analyze your competitor’s strategies

Once you know the pain points of your target audience, it’s the right time for you to conduct competitor research. Before you enter the market, you should know the environment you are entering.

Competitor analysis provides a roadmap of how they are performing and how you can stand out. Keeping a close eye on your competitors will help you know the current market trends.

While conducting market research for your mobile app, there are various regulatory compliances that you need to take care of. This industry is subject to various compliances, and data and security breaches result in losing thousands of dollars.

Thus, you need to comply with HIPPA and HITECH regulations if your medical insurance app is catering to people living in the United States.

3. Find a dedicated app development company

Now comes the part where you need to collaborate with technical vendors who have relevant experience building apps for the healthcare industry. Explore their portfolio section on the website to see whether they are a right fit for you or not.

Create a checklist of 10-15 companies and choose the one that matches your requirements. Partnering with a leading health insurance app development company gives you access to designers, developers, project managers, and testers who are there to revolutionize your business idea into a live app.

4. Choose the right platform – Android or iOS

Here, you need to decide where you want your app to deploy, such as Android, iOS, or the web. You must select an appropriate platform that aligns with your target audience’s needs.

For Instance – If your target audience includes elderly people mostly, they feel more convenient using the website.

In contrast, if the majority of your target audience belongs to the younger category, they prefer to go with apps.

5. Focus on creating better UI/UX design for an app

Creating an aesthetic UI/UX design is pivotal for the healthcare industry because it can improve the well-being of a patient.

An effective UI/UX design for a healthcare insurance app allows customers to easily access your digital product and provides a positive user experience.

When the user interface feels natural, the product is highly personalized for the customer.

According to Forrester, a better user experience improves the conversion rate to 400%.

When we talk about UI/UX, we do not keep ourselves confined to various product categories that are there on websites or apps.

A great UI/UX design in the healthcare industry is more about lifesaving.

A better UI/UX design is responsible for turning your healthcare app into a lead generation tool.

From data reports, we come to know that UI/UX design in the healthcare industry has an impeccable impact than any other industry.

While designing the user experience, use the right fonts, colors, and visuals because choosing the right colors creates a cozy atmosphere.

Moreover, a better UI/UX design in health insurance app provides various benefits for customers-

- Provides a customized experience to patients

- People with visual impairments or elderly people can access healthcare services on the go because accessibility is a legal requirement in various countries.

- Educate patients about how the product works.

Do you want to create an unforgettable experience for your customers?

6. Create a prototype

Before creating a fully-fledged application, it’s better to go with a prototype or beta version of an app.

Building a mobile app is always expensive because there are high chances that an app is developed and does not meet the intended requirements, go through multiple rounds of feedback, etc.

Here’s why developing a prototype is a GOLDMINE for your health insurance business-

- Building an app prototype won’t regret you at later stages of the app development process because you can know the exact reason if users are not using the app prototype.

- Developers can get instant user feedback and make necessary modifications as and when required.

- Test your prototype across multiple devices.

7. Perform an app testing

Testing the health insurance app is important to identify flaws and bugs so that user experience is not affected. The Q&A team must test whether the application is meeting the desired standards of quality or not.

At BigOhTech, our Q/A testers perform both manual and automated testing to ensure that you get a functional product at the end that is bug-free. So, if you are struggling to get a quality product, contact our software testing consulting company.

We use the best tools to ensure your health insurance app remains secure, satisfies your users, and increases your business revenue.

Also Read: Digital Transformation In Healthcare: Benefits

How much does it cost to create a health insurance mobile app?

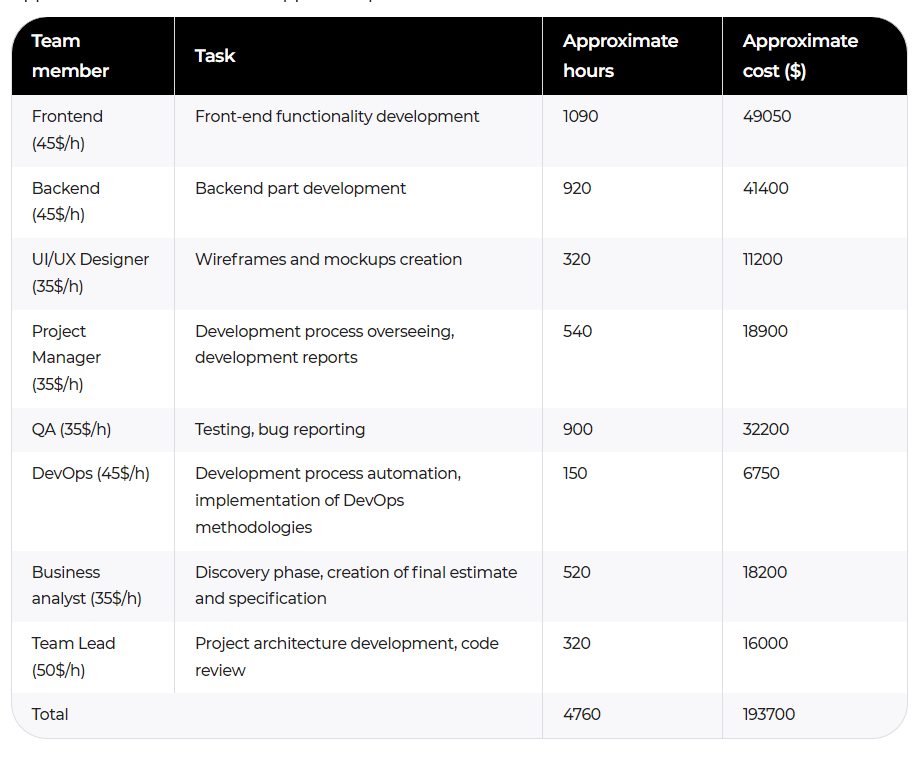

To give you a ballpark figure, the estimated cost for developing the health insurance app ranges between $55,000 -$2,50,000. Our business analysts have calculated the health insurance mobile app development costs based on the hourly rates of each member.

The cost of health insurance mobile app development differs depending on various factors such as-

- Technologies required to develop an app,

- How complex the application is, the size of the development team,

- Hourly rates of development specialists,

- The location of the development team, and

- How soon you want your application to be developed.

Basically, there are 3 types of development models you can choose –

- Hiring in-house developers is the most expensive option because you must bear the cost of hiring employees, paying them salaries, paying for leave days, bonuses, equipment, etc.

- You can choose freelancers, but if the project is complex and requires protecting the patient data and complying with necessary compliances, then it would not be a feasible option.

In terms of cost, it is more affordable for you, but you have to bear the cost in the long term because of their negligent behavior.

- Lastly, partnering with an outsourcing company that specializes in developing health insurance apps is the most affordable option for you as you get everything under one roof and within the stipulated timeframe.

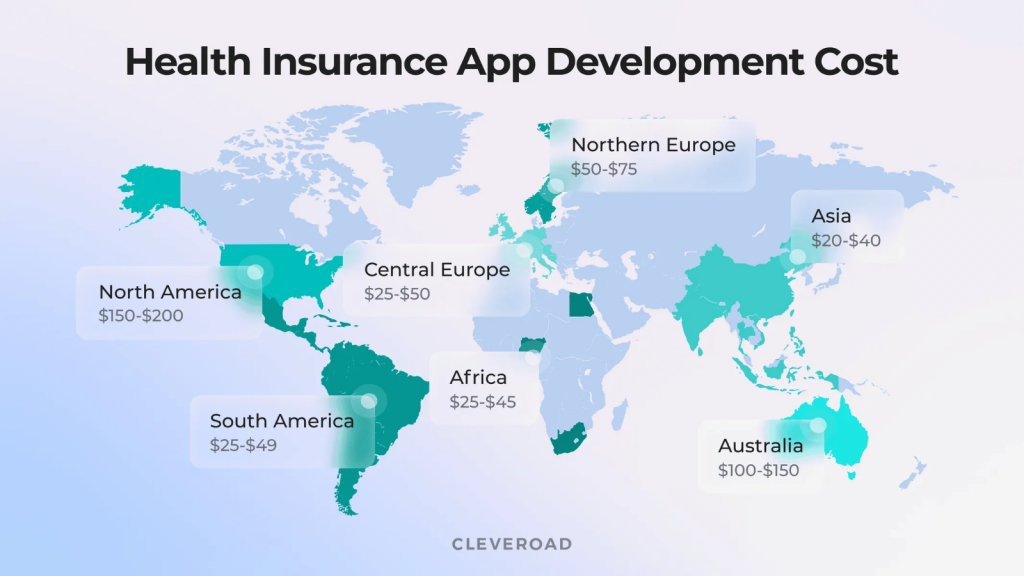

The image below gives you an overview of health insurance app development costs by region.

End notes

Developing an interactive healthcare application is a challenging process; it takes your time and effort to build an app that helps you stand out from the crowd.

Successful development of health insurance app provides various benefits to you such as no more paperwork, selection of appropriate plans, and easy access to doctors.

Having an in-house team can help you create a robust and highly performing application. What if you don’t have access to such professionals or run out of budget?

In such a case, outsource software development work to a dedicated app development team who have years of experience in developing health care and health insurance apps.

Our mobile app development process starts with knowing your customer requirements first, and we can learn about your business vision and app objective once we have an introductory call with you.

After dealing with various clients worldwide, we learned from our clients that only a few insurance players have interactive mobile apps. And we don’t want you to be stuck with that and let you lose all your money on the table.

We bring all our expertise to the table and develop a successful health insurance app that provides you various functionalities –

- Protecting patients’ data

- Access different insurance plans on the go

- Check the status of claims

- Find a plethora of doctors and healthcare professionals

- Buy and renew policy

- Make in-app premium payments

Do you need help in digitizing your insurance business? Connect with our app development experts now and supercharge your business revenue.