The use of smartphones has been increasing and everyone is inclined toward digitalization of resources for better convenience.

That’s how the E-Wallet replaced the old method of having a wallet in physical form and can handle the problems related to Finances and make the transaction process easy and feasible.

According to Statista, Transactions through Digital platforms are projected to reach US$254.60bn in 2024.

The overall transaction value is expected to show an annual growth of 11.56 %resulting in a projected total amount of US$394.40bn by 2028.

If you are someone who owns a business and looking for a diverse offering to the customers and want to develop a highly profitable app for your customers and your business, then creating an E-wallet would be very beneficial for your business.

In this blog, we will dive into a thorough explanation of how you can develop a successful E-Wallet App efficiently and effectively and how it can be a game changer for your business.

What is an E-Wallet app?

The E-wallet app, which is abbreviated as an electronic wallet app, allows you to store all your payment information including credit/debit card details, bank account info, or even cryptocurrencies in one place.

These apps simplify purchasing, and payment options for goods and services and keep track of loyalty points or coupons. They allow you to make your transactions faster and more conveniently.

Uses

1. Payment Info: Add your credit or debit card to the app. Most e-wallets can even be tied to your bank, and in the future will digitally hold cryptocurrencies.

2. Purchase & Spend: You can spend using the app at participating merchants, online, or sometimes even physically by scanning a QR code or NFC (Near Field Communication).

Popular examples of E-Wallet apps include PayPal, Apple Pay, Google Wallet, and Samsung Pay.

Features of E-Wallet App

Digital Payment storage

It stores multiple cards for easy access and use which helps users to make transactions easily without entering the card details before the transaction.

Online Purchases

E-wallets simplify the process of online shopping providing users to shop in one click or tap by connecting with major e-commerce platforms and merchants.

In-store payments

It allows users to make contactless payments using NFC (Near Field Communication) or QR codes at physical retail locations. This feature fastens the checkout process and minimizes the need for physical cards.

Bill payments

E-wallet apps make it possible to deposit invoices with just one click and offer a dependable, user-friendly method for Rent, Mortgages, Electricity, Gas, etc.

Transaction History and Notifications

In your app, this feature allows users to track their history, and the transactions made before and always provide push-up notifications about the user’s account activity to make more user engagement on the app.

Security Features

You need to work intensively with the security features within the app to secure data and make users feel safe while using the app.

E-Wallets use strong encryption protocols to ensure tight security of User data and maintain privacy.

Some E wallets use two-factor authentication factors to provide an additional layer of security for sensitive actions that help users feel safer and more secure while using your app.

Peer to Peer payments

This method is very useful for making the transaction process easy for the customers where users can link their social media platforms like Facebook, and WhatsApp with the E-wallet account and can send or receive money by social media platforms.

Types of E-wallet app

There are different types of E Wallet apps such as Google Pay and Apple Pay.

These apps let you securely save your credit or debit card information so that instead of pulling a physical wallet out, entering a number, or swiping anywhere, online and offline payments are immediately processed.

1. Closed Wallets

Closed wallets issued by a particular business or brand that are limited to use within that business’s partner network or ecosystem are known as closed wallets.

Only a certain merchant or group of merchants may complete transactions.

For instance, you can only use your Amazon Pay wallet to make purchases from Amazon or its related businesses.

2. Semi-closed Wallets

Although semi-closed wallets have several limits, they are still more adaptable than closed wallets.

They don’t permit transfers to other bank accounts or cash withdrawals, but they do let transactions with a variety of merchants within the wallet provider’s network.

Paytm is the perfect example of semi-closed wallets that are frequently used for online and in-store payments at a variety of retailers, bill payments, mobile recharge, and shopping.

3. Open Wallets

The most functional option is open wallets, which are offered by banks or other financial organizations. They can be used for various activities, such as fund transfers, ATM withdrawals, and Internet shopping.

Essential attributes:

Flexibility in Use: Almost any transaction, including interbank transfers, ATM withdrawals, and payments made both online and offline, can be made using this feature.

Integration: Usually connected to a credit/debit card or bank account, enabling a smooth interaction with conventional banking services.

Crypto wallets: Crypto wallets are applications used to store various cryptocurrencies. Unlike other wallets, crypto wallets do not hold any physical currencies, they use unique addresses and keys of your digital currency.

These E Wallets make the process of sending and receiving cryptocurrencies very easy. Transaction of cryptocurrencies works on blockchain technology.

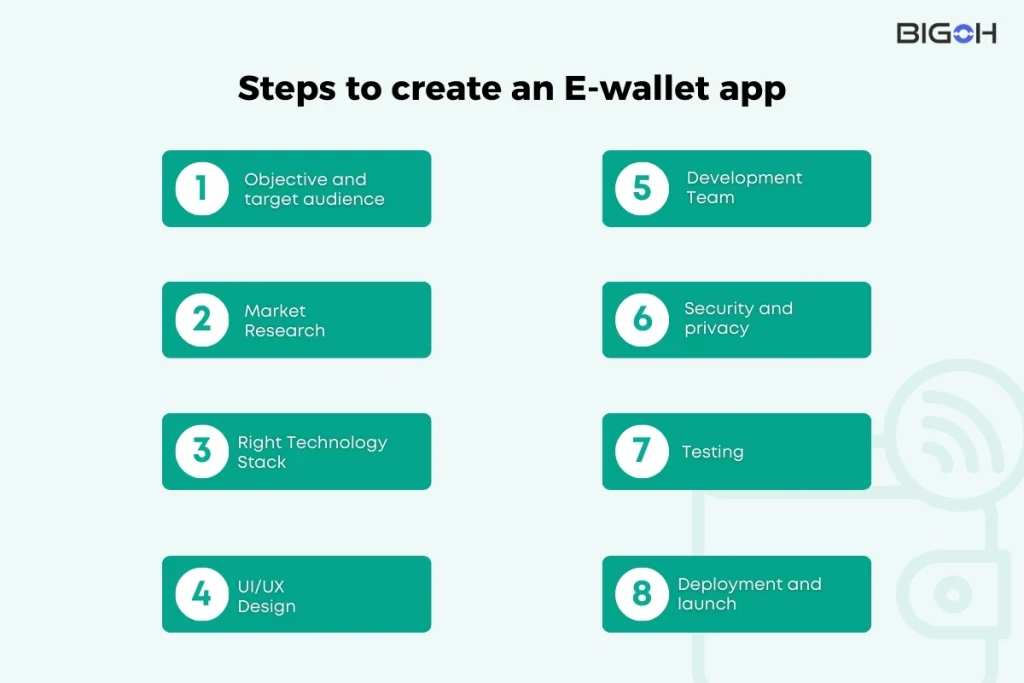

Steps to create an E-wallet app

1. Objective and target audience:

Clarity about your wallet is the most important and foremost thing, what you want your wallet to achieve by targeting the right audience.

Knowing the needs and preferences of the audience will help you in developing the wallet according to the problems faced by them, hence allowing you to solve their issues efficiently.

2. Market Research:

Market research covers two sides. One is the point of view of the provider, knowing what others in the market are providing and what innovation you can offer rather than copying others.

Second, think about the prevalent issues faced by the users in other wallets, hence filling those gaps through your wallet.

3. Right Technology Stack:

Choosing the right technology stack is the crucial part of making a successful E-Wallet app which platform would you choose for the development of an app whether it is iOS, Android, or both?

Cutting-edge technology should be used in payment gateway, app updates, and regular maintenance of the app.

4. UI/UX Design

Based on your audience’s requirements, you must use a native or hybrid approach while designing the wallet.

The app should be easy to use, and the interface should be engaging because this gives the overall look of the app and its features and enhances users’ engagement.

Real-time testing should be done to understand the working of the app to know if it is meeting the user requirements or not.

5. Development Team

The back-end team of your app should be robust and quick to respond as it involves all the data processing on the app. Moreover, it should be in sync with other teams of the project like the front end and the application programming interface.

6. Security and privacy

Security should be a paramount feature of your e-wallet app development as it involves the financial information of users.

Various security features such as two-factor authentication, face recognition, and retinal scans should be used to create trust among the users.

7. Testing

Before launching the digital wallet, it should be tested thoroughly on various ends such as performance testing, and security testing to catch the bugs, to know if its intended purpose is served or not.

8. Deployment and launch

Launching and deploying seems to be at an end but it is not. After launching your e-wallet on the Android Play Store or Apple Store you should keep an eye on the apps working and necessary updates according to the user’s feedback.

How much does it cost to develop an E-wallet app?

The cost of development of any app depends on various factors like the complexity of the app, platform, tech stack, and many more.

The total cost of developing an e-wallet app ranges between $20000- $ 100000 depending on the complexity of the app.

| Basic E Wallet | $25000- $50000 |

| Intermediate E-Wallet | $30000- $80000 |

| Basic E-Wallet | $50000- $100000 |

Tips for successful e-wallet development

- Your app should have Unique Selling point and not the copied product that is already in the market.

- Your e-wallet should be able to fill in the gaps that are prevalent in other E-wallets

- Accessible and efficient customer service should be available.

- The security and privacy of users’ data should not be compromised at any cost.

- You should hire a good development team that works dedicatedly on e-wallet updates and its advancements.

Conclusion

In the digital era where almost everything is digital, so is the way of managing our finances. So, to make the process of finances easier for the customer, e-wallet apps play a crucial role in it.

If you want to develop a successful E-Wallet app then you must be aware of those things and features that are not available in other e-wallet apps and should know about the necessary things that are mentioned above.

As we mentioned that good development team should be there to work dedicatedly on the app, so for this you can hire a team from BigOhTech and connect with us that ensures you get everything done in one place without going through the exhaustive process of searching, hiring, and assembling the team.

FAQs

Q.1 Can you tell me some successful Mobile wallets?

Yes, various successful wallets are enjoyed and used efficiently by users like Google Pay, Amazon Pay, Pay Pal, Paytm, and many more.

Q.2 What are the advantages of Digital Wallet Development for Businesses?

There are many advantages of developing a Digital Wallet for business because Digital wallets enhance customer experience, provide faster and secure payments and reduce transaction costs. It boosts efficiency and engagement.

Q.3 What is the popular Technology Stack Used For e-wallet App Development?

The popular technology stack used for E-wallet App Development is Kotlin, Swift, CSS, and many more for Frontend Development and PHP, NodeJS, Python, Java, etc. for backend Development.