Fintech is one of the emerging technologies today. There has been an increasing popularity in the fintech app development sector.

Because of the COVID pandemic, more people started relying on digital solutions for financial needs such as tracking earnings, analyzing spending habits, etc.

Developing a Fintech app is a valuable tool for individuals to manage their finances and make informed decisions regarding where to invest money.

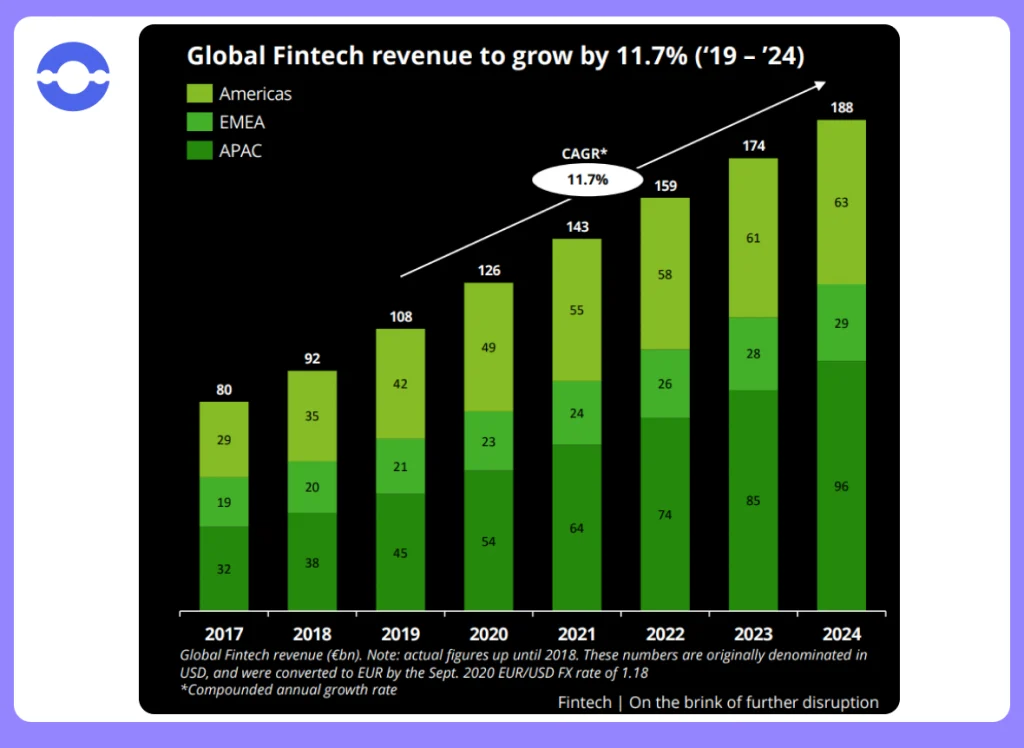

Research studies show that the Fintech industry is not slowing down.

As per Deloitte’s report, the global fintech revenue was €92 billion in 2018 and is expected to increase by more than €188 billion in 2024.

The report also outlined that the share price of Fintech outperformed the traditional financial service industry in the past 2 years.

So, to stand out in this competitive landscape, you must create a fintech app that serves your users and adds value to their lives.

When such an industry proliferates, why not develop a Fintech app and take your business to the next level?

Let’s share some insights with you on a fintech app, types of financial apps, step-by-step guide in building a fintech app, and what features you should include while developing a next-generation fintech app.

What is a Fintech App?

The Fintech market is growing. According to Fortune.com, nearly 9 out of 10 Americans prefer using Fintech apps to manage their finances.

In fact, they are spending their day and night on Fintech apps more than any video streaming subscription service and social media.

Not only did the Fintech sector experience a 40% year-on-year growth, but also there has been a massive increase in users’ adoption of Fintech platforms.

The term Fintech is a combination of 2 words – Finance and technology.

A Fintech app is an application that uses technology to provide financial services (investment banking, digital payments, online banking) for users and compete with traditional financial institutions.

Creating a Fintech app benefits companies and users. Here, users can manage their finances. On the other hand, companies can offer customers financial services such as cryptocurrency and blockchain.

Fintech companies are growing in popularity, and these apps offer products or services that can be accessed through smartphones, mobile devices, or tablets.

The introduction of Fintech apps has helped users and businesses in various ways-

- Because of its user-friendly interface, Fintech apps have made it easier for users to manage their finances.

- Fintech apps are cost-effective for users as they save money on banking and investment fees because they get everything under one roof.

- Financial companies can gain a competitive edge by launching Fintech apps.

In a nutshell, mobile applications and technologies that are there to automate traditional sources of finance fall under Fintech.

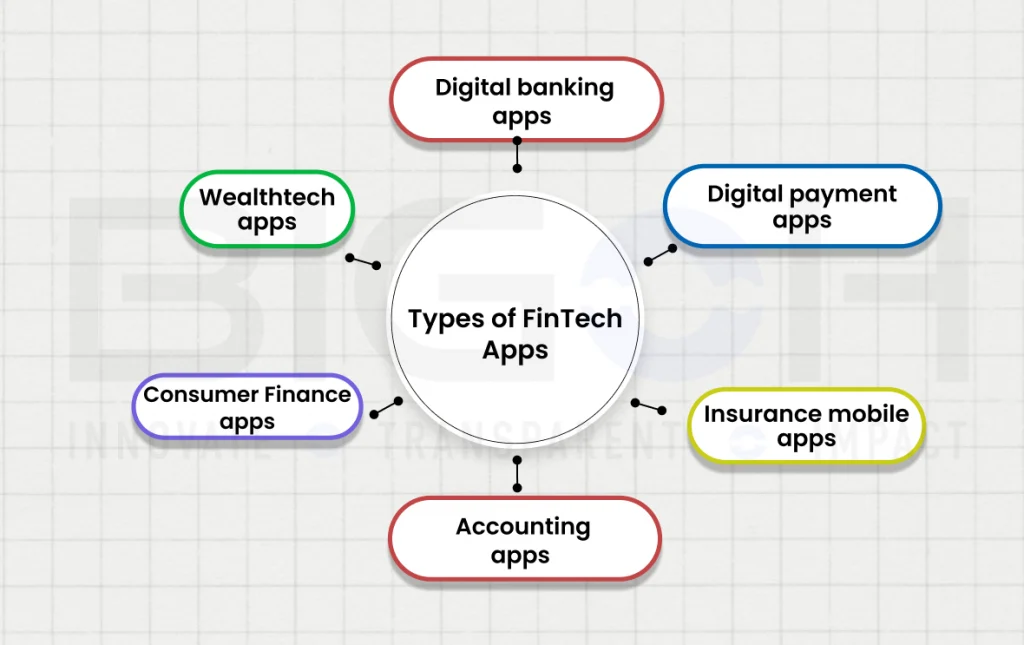

Types of Financial Apps

There are plenty of Fintech apps available for businesses, such as-

1. Digital Banking Apps

Digital banking app allows users to manage their bank accounts on the go. Say goodbye to the hassle of visiting a physical bank location.

Building such a fintech app allows a person to do everything they can while visiting a bank, such as opening an account, checking account balances, transferring funds, making payments, etc.

For Instance – Monobank is a popular fintech application that provides access to digital banking features, has a user-friendly interface, facilitates fast payments, and consists of a few gamification elements.

2. Digital Payment Apps

Digital payment is another popular category of Fintech apps.

These apps make it easier for people to make hassle-free payments without requiring a debit card or credit card.

Such apps have disrupted traditional payment systems by providing a seamless payment experience to customers.

3. Insurance Mobile Apps

Fintech app development has revolutionized the insurance industry. These apps provide several benefits to Insurance companies, helping them to speed up the claim processes, reduce fraudulent activities, payment processing, etc.

On the other hand, such apps make customers’ lives easy as they can manage their insurance plans that benefit them most.

For Instance – Geico mobile is a popular example of an auto insurance app having various features as given below-

- A digital ID card is allocated for examining insurance policies

- A virtual agent is assigned for answering queries

4. Wealthech Apps

The prime objective of designing such apps is to help novice traders and experienced investors manage all sorts of investments in one place, from bank accounts to stocks.

Moreover, these apps are a perfect place for users to research and find lucrative investment schemes.

5. Consumer Finance Apps

The prime motto of creating such fintech apps is to help users save money, estimate future expenses, and manage them on the go.

Some features of consumer finance apps include setting financial goals, keeping track of bills and expenses, analyzing investments, sending fraud alerts, etc.

For Instance – Mint is a consumer finance app for tracking payments, budgeting, and enrollments.

6. Accounting Apps

Such apps are helpful to small businesses as they can manage their financial accounts and bookkeeping processes. Some features of these apps include tracking expenses, preparing invoices, managing receipts, calculating taxes, etc.

These apps eliminate manual processes – save time and reduce errors. Thus, it is helping business owners to focus on other important business operations.

For Instance – Quickbook is a popular accounting app that provides a range of features to users, such as invoicing, tracking expenses, preparing taxes, and bank reconciliation.

How to Build a Personal Fintech Application?

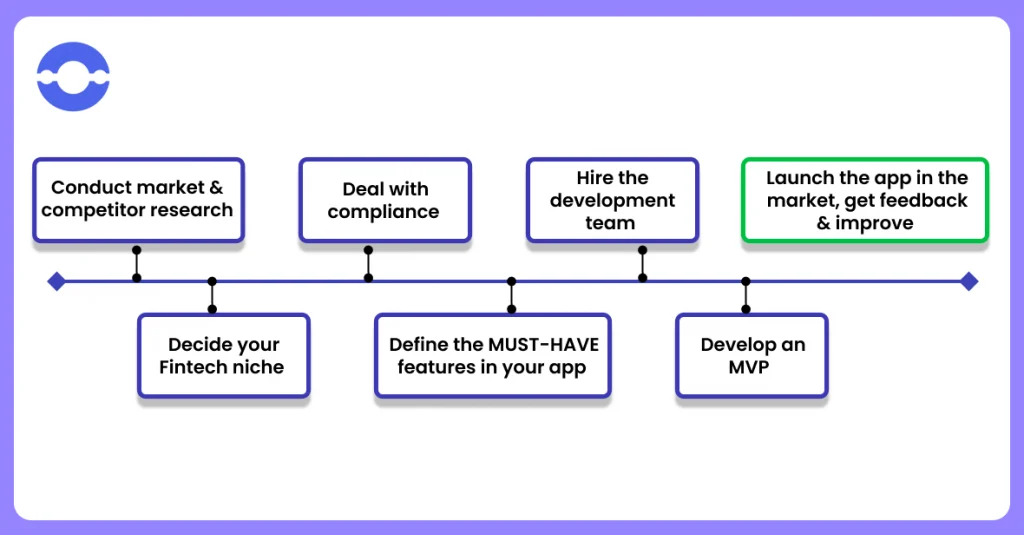

Here’s a step-by-step guide on building a secure fintech application-

1. Conduct Market and Competitor Research

Market research plays a significant role before you decide to create a fintech application. Every mobile app has certain pros and cons.

So, you need to study the competitive landscape to understand what features to include in developing a next generation fintech application.

2. Decide Your Fintech Niche

Don’t just jump over developing a fintech application now. Take some time to do the research from your side. All these things will help you figure out what type of fintech niche you want to enter and which area of Fintech you want to focus on.

Know which type of fintech application you want to develop – personal finance, crowdfunding, global money transfer, etc.

After doing this, figure out who your ideal customer is, their pain points, and what they are struggling with.

Having set all these things will smoothen your fintech app development process.

3. Deal With Compliance

Before deciding on app features, you must be aware of fintech legalities.

As Fintech is a highly regulated industry, you should be aware of implementing perfect protection systems such as AML (Anti-money laundering), KYC (Know your customer), etc.

Besides that, you should also comply with other privacy laws, such as CCPA, GDPR, LGPD, PIA, etc., to protect the financial data of app users.

For Instance – If you are developing a Fintech app in Europe, you must comply with GDPR compliance (General Data Protection Regulation).

So, consider the specific legal requirements per the target audience region because if a breach occurs, you will be liable for questioning.

4. Define the MUST-HAVE Features in Your App

After market research, you must decide on the must-have features to include while developing FinTech applications.

Don’t stuff too many features in your app; add the necessary ones to make it cost-effective, innovative, and mobile-friendly.

The feature of an app depends on the type of fintech app you want to create.

Some of the common features to include in developing a fintech mobile app are as given below-

- Creating a profile of the user

- Categorization of expenses

- 2-factor authentication

- Secure Login

- Including financial operations such as digital payments, checking balances, etc.

- Offers, cashback, and other deals

5. Hire the Development Team

If you want access to qualified app professionals with expertise in the fintech app development domain, consider outsourcing. This will save you time and money and help you accomplish your app development goals.

Fintech is a combination of 2 terms – Finance and technology.

So, you need to consider hiring professionals with expertise in both areas.

Let’s say you are interested in developing a cross-platform fintech application. In such a case, you need to hire app developers for both Android and iOS platforms.

Of course, the app development process takes a bit more time, but you will get 2 apps for different platforms.

Generally, the Fintech app development team comprises the following-

- Front-end and back-end developers

- Business analyst

- Project manager

- Designer

- QA Specialist

Before onboarding the development team for your project:

- Check the experience of app developers.

- Ask about their hourly rates.

- See whether they have expertise in the fintech app development domain.

- Select the right technology stack

Creating a fintech application requires you to know the right technology stack. Picking up the wrong tech stack might create adverse consequences for you.

Depending on app features and complexity, you need different tools for the front and back end. As every project requires other tech stacks, there is never a one-size-fits-all approach for developing mobile and web fintech solutions.

Technologies used to develop Fintech include Python, Java, Kotlin, C#, C++, etc.

6. Develop an MVP

By developing MVP, you can evaluate whether your idea is worth it. Developing an MVP covers adding basic features to an app.

It’s always a good idea to test your app idea before launching it in the market. Thus, it will save your development time and cost.

Launching an MVP in the market helps you get feedback from customers.

If you get positive feedback from customers and it seems that MVP is adding value to customer’s life, you can work on adding advanced functionalities.

Need help in launching your MVP?

7. Launch the App in the Market, Get Feedback and Improve

The fintech app development is an ongoing process. It will never stop even after launching your app (budgeting, personal finance, investment). Make sure to update your app regularly based on the feedback you get from customers.

Thus, you will be able to develop a top-notch product that meets users’ needs.

What Features to Include in the Fintech App?

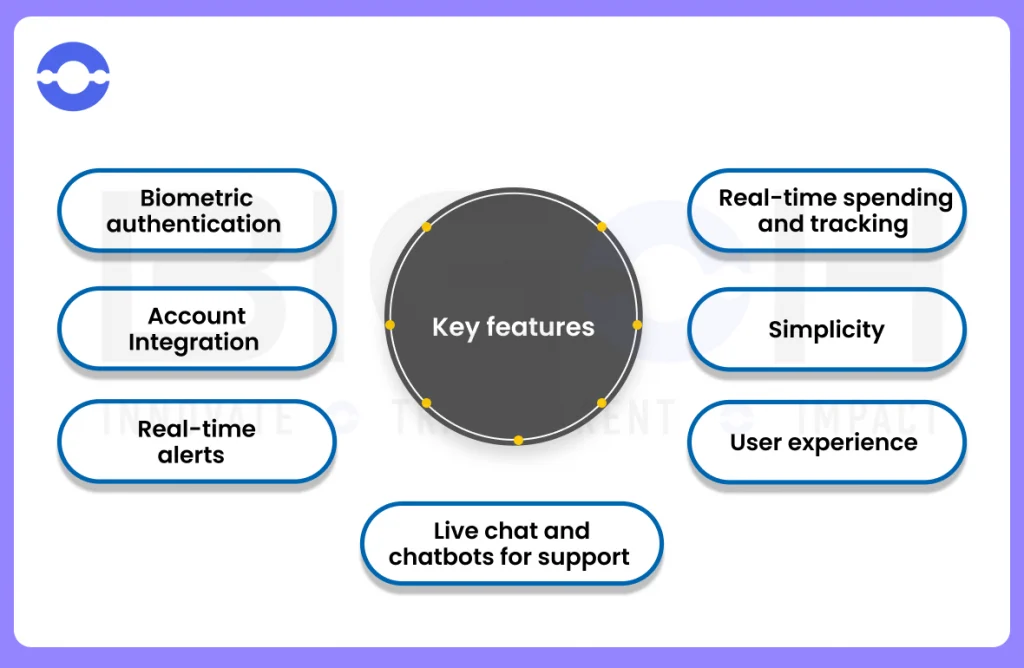

You need to have some key features in mind when building a fintech app-

1. Biometric Authentication

If you have decided to develop a money management app, adding a biometric authentication feature is a BIG YES. With this feature, a person’s unique characteristics are considered, such as facial features, voice recognition, fingerprint, etc.

2. Account Integration

Your fintech app should be a one-stop solution for performing money-related operations or setting investment goals for the next quarter.

With the integration of your app with other financial apps, users won’t need to switch back and forth to transfer their money as they can access everything on a single platform.

3. Real-Time Alerts

A real-time alert feature builds customers’ confidence as they won’t miss anything. Such alerts and notifications always keep your customers informed about their finances. It is a great way to increase user engagement and improve the app experience.

4. Live Chat and Chatbots for Support

Integrating AI Chatbot functionality in a fintech app makes it convenient for customers to keep track of their finances and ask questions.

Such chatbots keep track of customer budgets and provide insights into credit scores.

5. Real-Time Spending and Tracking

When building a personal finance application, include a real-time spending and tracking feature to help customers track their expenditures on a single platform.

6. Simplicity

Create a simple app because no one likes to go through the pain of transacting or investing every time. Create an app that lets customers use the app by doing 3 simple taps.

7. User Experience

Your app might fail if you are not paying attention to UI/UX. Include user-friendly features that are easy to navigate.

A better user experience is responsible for ensuring whether customers love accessing your application or not.

Are you struggling to create a good UI/UX design?

Wrapping Up

Now is the right time for you to move to the next step and start your fintech app development journey with us. We know how difficult it is for you to create a fintech app that makes your business stand out.

But, with the right software development team, we can make it easier for you. Launching the fintech app can transform your finance business and provide better customer experiences.

You have the best idea but need help finding the best development team.

Head over to our website’s contact section and talk to our app development experts now.

FAQs

There is no such fixed cost for developing a Fintech app.

Fintech app development cost depends on various factors such as the type of fintech app, development time, location of the app development agency, and features to include in the fintech app.

To give you a ballpark figure, the average cost of developing a Fintech app starts with a minimum price of $40,000.

If you want to create a banking application with a minimal app interface, it will cost around $30,000 – $50,000.

Developing a simple fintech app takes around 3-6 months, while if it is a complex one, it would take around 12-18 months. However, the time required to develop an app would vary depending on project requirements and the type of app your business needs.